Public Finance

Two periods must be distinguished:

The first period, between 1993 and 1997, witnessed primary deficits averaging 8% of GDP.

The second era came after 2001, when the primary deficits did not exceed 1%.

Thus, the political-economic system has adopted, in the first stage, the option of spending without reckoning, betting on regional peace and striving to focus on its client base (excess of employment, nepotism contracts…) without concern for the accumulation of debt.

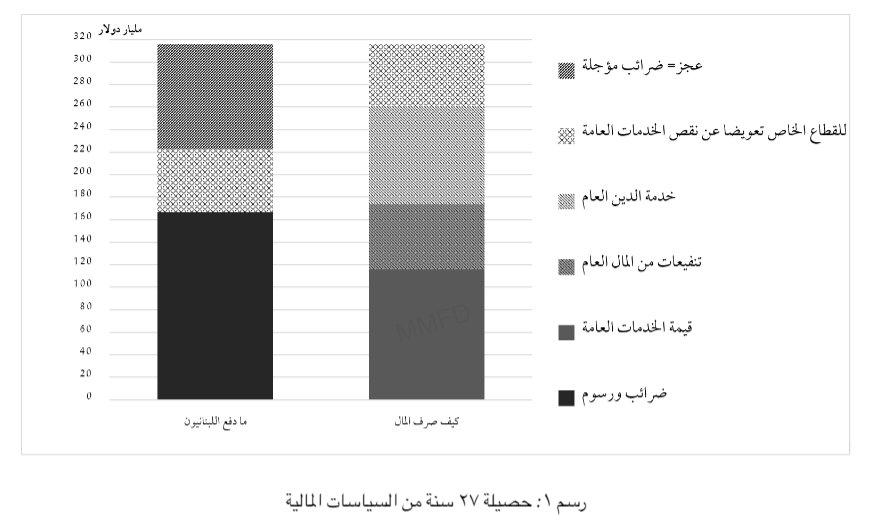

The total amount of declared and implicit taxes that the Lebanese have paid is estimated at $316 billion for services whose economic value does not exceed $116 billion, or 37%. The rest went as interest on debt and as clientelist distribution. This coincided with an annual public deficit in the balance of goods and services amounting to 25% of GDP, which was covered by capital inflows. These flows accumulated inflated bank liabilities, which allowed financing a huge amount of consumption and an increasing, exaggerated demand in the real estate sector.